Life insurance plans chapter 9 lesson 5 worksheet answers – Delving into the intricacies of life insurance plans, Chapter 9 Lesson 5 delves into the essential components and considerations surrounding these financial instruments. This comprehensive worksheet provides a structured approach to understanding the various types of life insurance plans, their key features, and the factors that influence their analysis and selection.

Through a meticulous examination of real-world examples and detailed explanations, this worksheet empowers individuals to make informed decisions regarding their life insurance coverage. By addressing common questions and providing practical guidance, it serves as an invaluable resource for navigating the complexities of life insurance planning.

Life Insurance Plan Overview

Life insurance plans provide financial protection for individuals and their loved ones in the event of death. They offer a lump sum payment to the designated beneficiaries, which can be used to cover expenses such as funeral costs, outstanding debts, and future income replacement.

There are various types of life insurance plans available, each with its own unique features and benefits. These include:

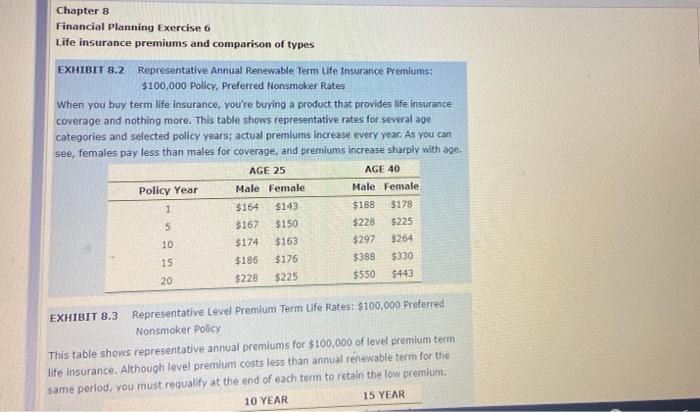

- Term life insurance:Provides coverage for a specific period, typically ranging from 10 to 30 years. It is generally more affordable than other types of life insurance.

- Whole life insurance:Offers lifelong coverage and builds cash value over time. The cash value can be borrowed against or withdrawn for various purposes.

- Universal life insurance:Combines the features of term and whole life insurance. It provides flexible coverage amounts and premiums, as well as the potential for cash value growth.

Chapter 9 Lesson 5 Worksheet

Question 1:Define life insurance and explain its purpose.

Answer:Life insurance is a financial contract that provides a lump sum payment to the designated beneficiaries upon the death of the insured individual. Its purpose is to provide financial protection for the insured’s loved ones and cover expenses such as funeral costs, outstanding debts, and future income replacement.

Question 2:List the different types of life insurance plans.

Answer:

- Term life insurance

- Whole life insurance

- Universal life insurance

Life Insurance Plan Analysis

Key Components of a Life Insurance Plan:

- Death benefit:The amount of money paid to the beneficiaries upon the insured’s death.

- Premium:The amount paid by the insured to maintain the coverage.

- Policy term:The period of time during which the policy is in force.

- Riders and endorsements:Optional add-ons that provide additional coverage or benefits.

Factors to Consider When Analyzing a Life Insurance Plan:

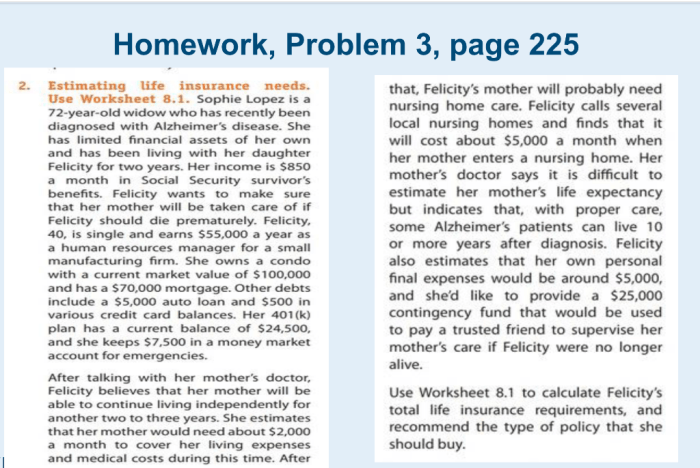

- Coverage amount:Determine the amount of financial protection needed for your loved ones.

- Policy term:Consider the length of time you want to be covered.

- Premium affordability:Ensure that you can comfortably afford the premiums.

- Riders and endorsements:Evaluate the need for additional coverage or benefits.

- Financial stability of the insurance company:Choose a company with a strong track record and financial stability.

Plan Comparison and Selection

Comparison of Life Insurance Plans:

| Feature | Term Life Insurance | Whole Life Insurance | Universal Life Insurance |

|---|---|---|---|

| Coverage Duration | Specific period | Lifelong | Flexible |

| Premiums | Generally more affordable | Higher than term life | Variable based on coverage amount and cash value |

| Cash Value | No | Yes, accumulates over time | Yes, potential for growth |

| Flexibility | Limited | High | Moderate |

Process of Selecting the Most Suitable Life Insurance Plan:

- Assess your financial needs and coverage requirements.

- Compare different life insurance plans and their features.

- Consider your budget and affordability.

- Consult with an insurance agent or financial advisor for guidance.

- Choose the plan that best meets your specific needs and requirements.

Additional Considerations: Life Insurance Plans Chapter 9 Lesson 5 Worksheet Answers

Riders and Endorsements:

- Waiver of premium rider:Exempts the insured from paying premiums if they become disabled.

- Accidental death benefit rider:Provides additional coverage in the event of accidental death.

- Long-term care rider:Covers expenses related to long-term care, such as nursing home stays.

Role of Insurance Agents and Financial Advisors:

- Provide expert guidance on life insurance plans.

- Help assess your financial needs and coverage requirements.

- Compare different plans and recommend the most suitable option.

- Assist with the application process and ensure smooth policy issuance.

Tips for Maximizing the Benefits of Life Insurance Plans:

- Purchase sufficient coverage to meet your financial needs.

- Consider riders and endorsements to enhance coverage.

- Review your policy regularly and make adjustments as needed.

- Maintain your premiums on time to avoid policy lapse.

- Inform your beneficiaries about your life insurance policy and ensure they understand the process for claiming the benefits.

User Queries

What is the primary purpose of a life insurance plan?

To provide financial protection for beneficiaries in the event of the insured’s death.

What are the main types of life insurance plans?

Term life insurance, whole life insurance, and universal life insurance.

What factors should be considered when analyzing a life insurance plan?

Coverage amount, premium costs, policy terms, riders, and financial stability of the insurance company.